Crude oil is extracted

Petrol and diesel are made from crude oil. The oil is typically extracted by drilling into the earth’s surface where reserves have been found, either on land (onshore) or on the sea bed (offshore).

Petrol and diesel are made from crude oil. The oil is typically extracted by drilling into the earth’s surface where reserves have been found, either on land (onshore) or on the sea bed (offshore).

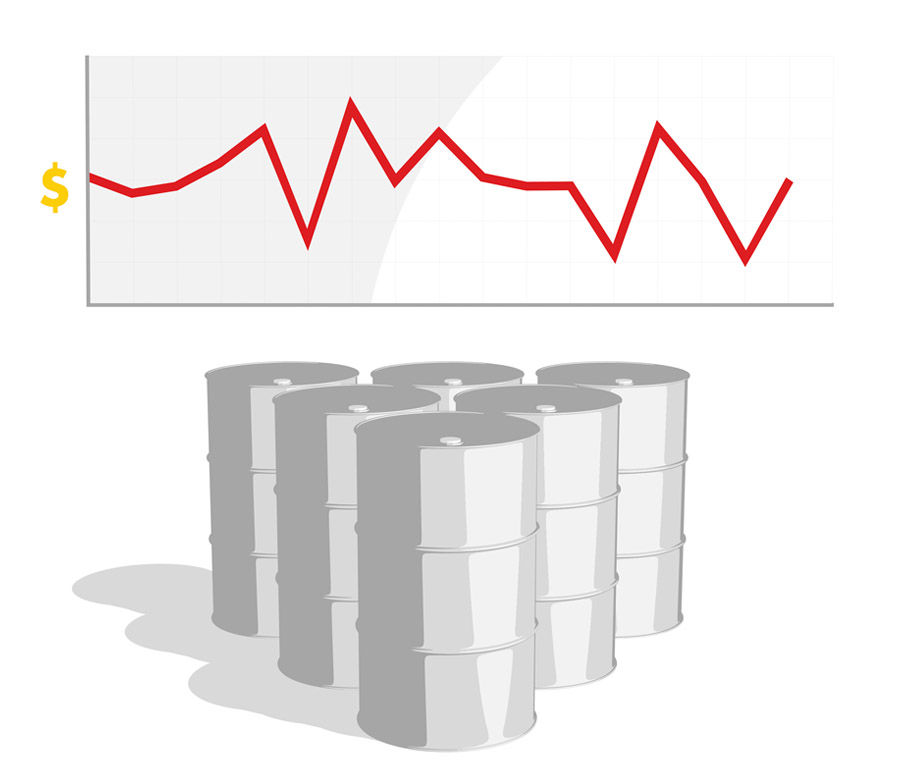

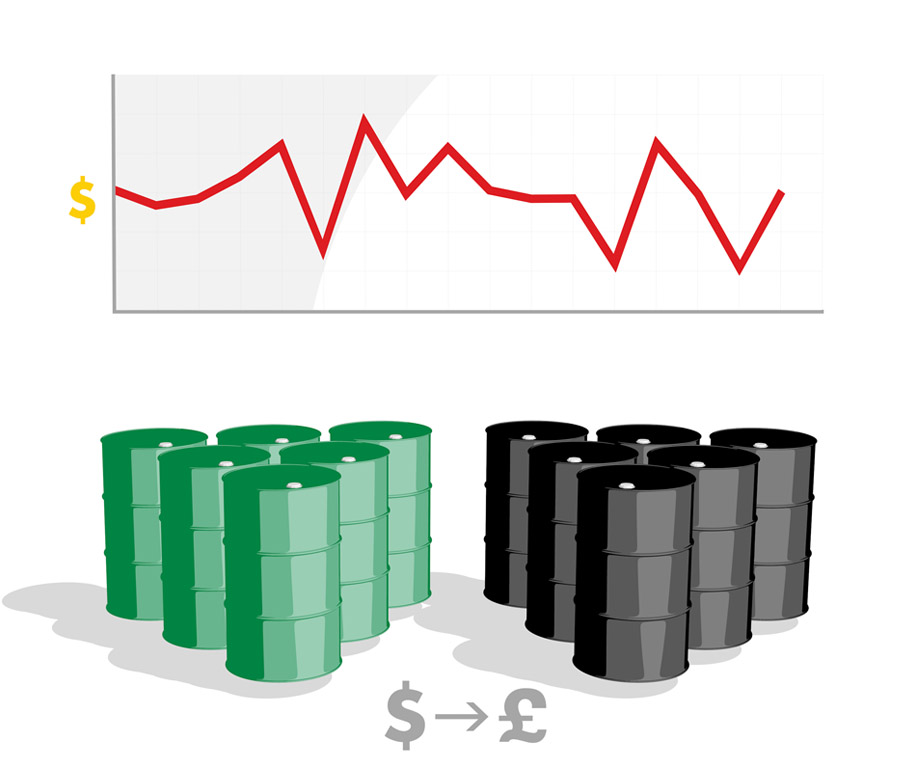

Crude oil is transported by ship or pipeline from where it is produced to refineries for processing. It is bought and sold on the global market, where it is traded in US dollars. The oil prices fluctuates depending on supply and demand.

Refineries process crude oil by heating it. This helps to separate the oil into different products, including petrol and diesel. They also make kerosene for aeroplanes and bitumen for roads and raw materials for chemicals which are used in millions of everyday products.

Refineries sell their products on wholesale markets, where prices also vary according to global supply and demand. Because oil products are traded in US dollars on the global market, the UK prices also fluctuate with currency exchange rates.

Fuel retailers, including Shell, buy petrol and diesel and take it to terminals ready for distribution to their retail sites. Service station staff costs, rent, maintenance and distribution expenses all add to the cost of supplying fuel to customers. Typically we make around 2% profit, or a few pence per litre, on our UK fuel sales.

Around two-thirds of the retail price of fuel goes to the government as Value Added Tax and fuel duty. Duty is fixed at 57.95 pence per litre, regardless of petrol and diesel prices. These taxes make UK petrol and diesel amongst the most expensive in Europe.

Product Cost:

Crude Oil &

Product Cost:

Crude Oil &

Wholesale costs27%

Product Cost:

Crude Oil &

Wholesale costs27%

Transport, retail

costs and profit 7%

Product Cost:

Crude Oil &

Wholesale costs27%

Transport, retail

costs and profit 7%

Tax: Fuel Duty

& VAT 66%

Product Cost:

Crude Oil &

Wholesale costs27%

Transport, retail

costs and profit 7%

Tax: Fuel Duty

& VAT 66%

Based on a price of 115.9 pence per litre (as of October 2016)